Audit Support

Tax preparation can be a daunting task, especially when the risk of an audit looms overhead. Many individuals worry about inaccuracies on their returns or the implications of being selected for a review by the IRS. Engaging a professional can provide peace of mind. They offer audit support, ensuring that every detail of your tax return is meticulously accurate. If an audit occurs, having someone who understands the intricacies of tax laws and regulations can significantly alleviate stress.

Professional tax preparers not only assist during the audit process but also prepare clients for what to expect. They can guide you through the necessary documentation and help you understand the specific issues that the IRS may focus on. This support is invaluable for anyone who has faced complicated financial situations. For those in regions like Texas, expert tax preparation in Texas specifically caters to local tax laws while providing audit support, making the process more streamlined and efficient.

Guidance During IRS Audits

Navigating an IRS audit can be daunting for many individuals. Having a tax professional by your side provides crucial guidance during these challenging times. They can help interpret IRS correspondence, organize necessary documentation, and prepare responses to inquiries. This expertise ensures that taxpayers approach audits with confidence and clarity, significantly reducing stress.

For those in Texas, tax preparation professionals are well-versed in the unique aspects of local tax laws and regulations. They offer tailored support to address specific concerns that may arise during an audit. Engaging a tax advisor not only aids in managing the immediate situation but also reinforces best practices for future filing.

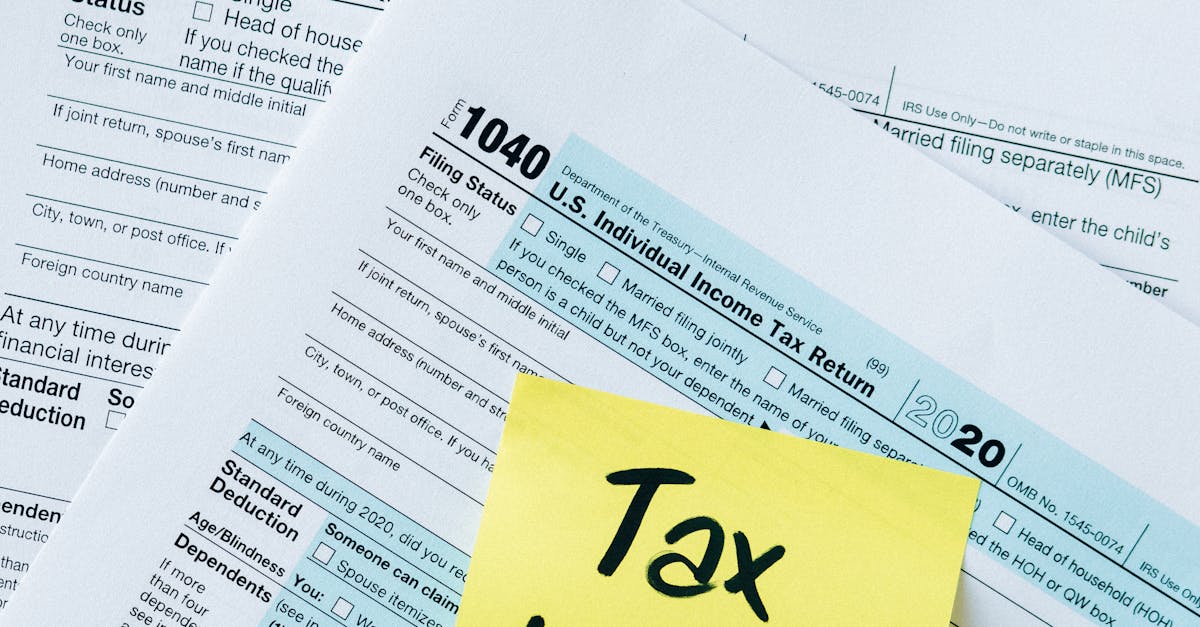

Understanding Complex Tax Situations

Navigating the intricacies of the tax code can be daunting for many individuals. Factors such as significant life changes, varying sources of income, or complex financial situations often lead to confusion. For residents seeking clarity in their tax filing, specialized services like Tax Preparation in Lubbock, Texas, offer invaluable insights. Professionals in this area possess the expertise to interpret tax laws effectively, ensuring compliance and maximizing potential refunds.

Business owners and investors face unique challenges as they tackle tax obligations. Various deductions, credits, and reporting requirements can easily become overwhelming without proper guidance. Engaging with a tax professional can provide tailored strategies to navigate these complexities, from understanding business expenses to managing investment income. Residents opting for services like Tax Preparation in Lubbock, Texas, benefit from advisors who stay updated on local regulations and tax incentives, facilitating informed decisions for their financial futures.

Navigating Business or Investment Taxes

For those managing a business or handling investments, navigating the complexities of tax laws can be daunting. These scenarios often involve multiple income streams, varying deductions, and unique regulations that can differ by state or industry. Seeking assistance from a professional can simplify this process. They bring an understanding of the nuances specific to your business structure or investments, ensuring compliance and maximizing potential benefits.

Tax Preparation in Lubbock, Texas, offers specialized support for local business owners and investors. Experienced tax professionals can help identify tax-saving opportunities that might go unnoticed by individuals handling their own taxes. Having access to such expertise not only aids in accurate filings but also reduces the stress associated with potentially costly errors.

Access to Advanced Software

Many tax professionals use advanced software that simplifies the filing process and ensures accuracy. These programs are designed to handle various tax situations and incorporate the latest tax regulations. By utilizing these tools, tax preparers can efficiently process clients’ financial information and minimize the likelihood of errors. This efficiency is particularly beneficial for individuals with complex tax situations or businesses that require detailed reporting.

In Texas, where tax laws can vary significantly, having access to specialized software can provide a tremendous advantage. Tax Preparation in Texas often involves intricate state regulations alongside federal requirements. Professional software can highlight deductions and credits specific to Texas residents, ensuring clients optimize their tax outcomes while remaining compliant with the law. This level of expertise and technology makes hiring tax preparers appealing, especially for those with diverse financial portfolios.

Utilizing Professional Tools

For individuals and businesses alike, the use of advanced tax software can significantly streamline the tax preparation process. Professional tax preparers often have access to tools that provide accurate calculations and keep up with changing tax laws. Utilizing these resources can help identify potential deductions and credits that might be overlooked by the average filer. Tax Preparation in Lubbock, Texas, offers a range of services leveraging these advanced systems, ensuring that clients get the most comprehensive support during filing.

Moreover, professional tools can facilitate error checking and audit trails that are essential in maintaining compliance. Tax preparers are equipped to address unique financial situations, incorporating industry-specific deductions or state-specific regulations into their service. This level of expertise is particularly beneficial for those seeking Tax Preparation in Lubbock, Texas, as it brings peace of mind and potentially maximizes refunds.

FAQS

What are the main benefits of hiring a tax professional?

The main benefits of hiring a tax professional include expert knowledge, personalized guidance, access to advanced tax software, and the ability to navigate complex tax situations, such as audits or investment-related taxes.

How can a tax professional assist during an IRS audit?

A tax professional can provide valuable guidance during an IRS audit by helping to prepare necessary documentation, communicating with the IRS on your behalf, and ensuring that your rights are protected throughout the audit process.

Are there specific situations where hiring a tax professional is more beneficial?

Yes, hiring a tax professional is particularly beneficial for individuals with complex tax situations, such as owning a business, having multiple income streams, or dealing with significant investments, as these scenarios can lead to more complicated tax obligations.

What types of advanced software do tax professionals use?

Tax professionals often utilize advanced tax preparation software that can accurately calculate deductions, optimize tax strategies, and ensure compliance with the latest tax laws, providing a level of precision that may be difficult to achieve on your own.

Is it cost-effective to hire someone to do my taxes?

While hiring a tax professional involves an upfront cost, it can be cost-effective in the long run by potentially maximizing your tax deductions, minimizing errors, and avoiding penalties, especially if your tax situation is complex or you are facing an audit.