Challenges Faced by Tax Preparers

Tax preparers often face a multitude of challenges throughout their careers. Seasonal work can create a rush of clients leading to high pressure and tight deadlines. Many preparers struggle to balance these demands while ensuring accuracy and compliance with the ever-changing tax laws. Additionally, client expectations can vary significantly. Some clients may want detailed explanations of the tax process, while others simply expect quick results. This disparity can make it difficult to deliver satisfactory service consistently.

Technology also plays a significant role in the challenges encountered by tax preparers. As software and tools evolve, staying updated can be a daunting task. New technologies can streamline processes, but they also require continuous learning and adaptation. For those seeking clients through online searches, a phrase like “Tax Preparation near me” highlights the importance of establishing a local presence. Failing to embrace these advancements might hinder both efficiency and competitiveness in a field that increasingly leans on tech solutions.

Navigating Seasonal Work and Client Expectations

Tax preparers experience a unique workflow dictated by the annual tax season. This period typically spans from January to April, during which demand significantly increases. Many clients seek assistance as deadlines approach, leading to heightened pressure on tax preparers to deliver accurate results quickly. Balancing multiple clients with varying complexity in their financial situations can be challenging. Ensuring open lines of communication becomes essential. Clear expectations regarding timelines, documents, and potential refunds can help alleviate anxiety for both parties.

Maintaining a strong relationship with clients is crucial in this demanding environment. Many individuals start their search for help by looking for “Tax Preparation near me,” indicating the importance of local presence and accessibility. Tax preparers must navigate client expectations while also managing their workload effectively. Providing timely updates and reminders helps manage both client satisfaction and workload. Adapting to diverse client needs and preferences significantly influences a preparer’s success. Building trust through transparency fosters long-term relationships, leading to repeat business beyond the busy tax season.

Technology’s Impact on Tax Preparation

Technology has transformed the landscape of tax preparation significantly. The introduction of sophisticated software solutions has streamlined many tasks that once consumed valuable time. As a result, tax preparers can now process returns faster and with greater accuracy. They can also offer clients a more convenient experience, enabling document uploads and information gathering through secure online portals. This shift not only improves workflow efficiency but also enhances client satisfaction, as individuals increasingly seek “Tax Preparation near me” using digital tools.

The rise of artificial intelligence and automation tools has further changed how tax professionals operate. These technologies assist in data extraction and analysis, reducing the potential for human error and allowing preparers to focus on more complex aspects of tax strategy. With AI, preparers are better equipped to analyze a client’s financial situation and provide tailored advice. Tech-savvy tax preparers who leverage these advancements can differentiate themselves in a competitive market, ensuring they meet the evolving expectations of their clients.

Tools and Software Enhancing Efficiency

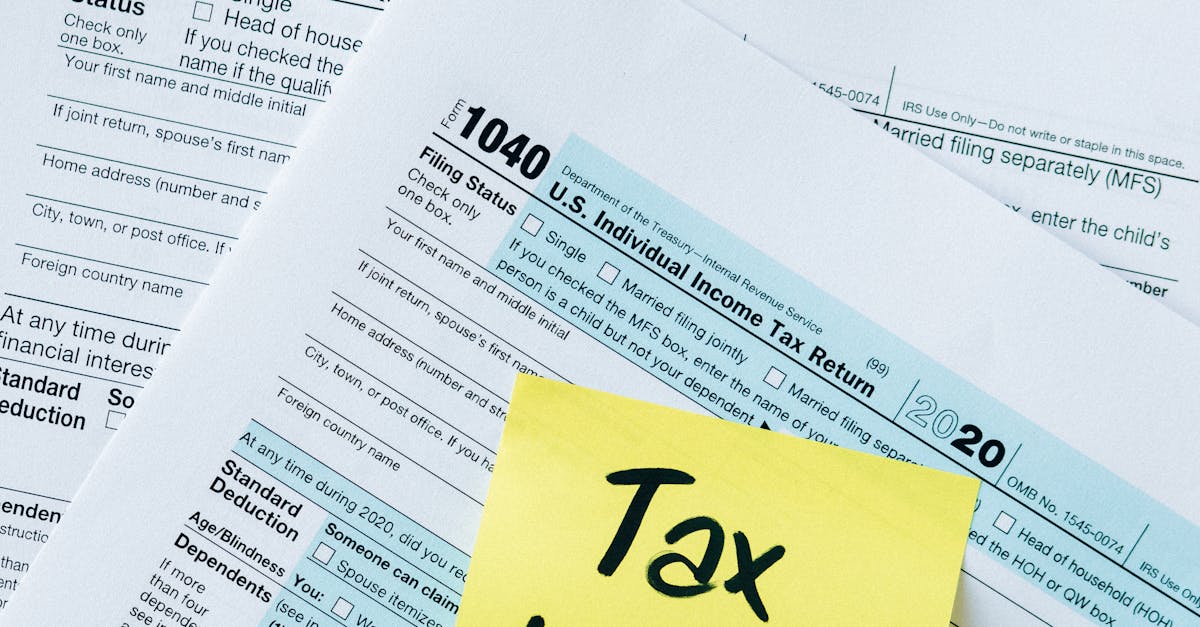

The landscape of tax preparation has evolved significantly with the advent of advanced software solutions. Tools like TurboTax and H&R Block streamline the filing process, allowing tax preparers to manage multiple client accounts efficiently. These programs come equipped with features that automate calculations, minimize errors, and ensure compliance with changing tax laws. Tax professionals benefit from integrating these technologies into their workflow, which enhances productivity and reduces the stress associated with peak tax season.

Additionally, cloud-based platforms have emerged, enabling preparers to collaborate with clients in real-time. This flexibility is particularly valuable for those searching for “tax preparation near me,” as clients can connect with their preparers regardless of location. With document sharing and secure portals, both parties can easily communicate and exchange necessary information. Embracing these technological advancements not only increases efficiency but also fosters a more responsive client experience.

Career Advancement Opportunities

Tax preparers have numerous avenues for career advancement within their field. Many start as entry-level preparers and can progress to senior roles or supervisory positions. Gaining experience and continuing education through certifications such as the Enrolled Agent designation can significantly enhance one’s qualifications. This further opens opportunities in specialized areas such as corporate tax or international tax, where expertise is in high demand.

Additionally, tax preparers can expand their services to include financial planning or consulting. Building a strong network and reputation in the community can also lead to increased business referrals, particularly when clients search for “Tax Preparation near me.” As they grow their clientele, many tax professionals also consider starting their own practices, which can offer greater control over work schedules and income potential.

Pathways to Specialization and Growth

Aspiring tax preparers can find numerous pathways for specialization that enhance their career prospects. Areas such as corporate taxation, estate planning, and international tax are prime for those seeking to deepen their expertise. Engaging in continuous education and obtaining relevant certifications can distinguish a tax preparer in a competitive market. Networking with peers and industry professionals also creates opportunities for mentorship, which can provide insights into niche markets.

Growth within the field often stems from a tax preparer’s ability to adapt and embrace new trends. Many preparers choose to focus on specific demographics or industries, tailoring their services to meet unique client needs. Utilizing search terms like “Tax Preparation near me” can help in attracting localized clients seeking specialized assistance. Expanding service offerings to include consulting and financial planning can further enhance a preparer’s value in the marketplace.

FAQS

What are the main challenges faced by tax preparers?

Tax preparers often encounter challenges such as managing seasonal work fluctuations, meeting client expectations, and keeping up with ever-changing tax laws and regulations.

How does technology impact the tax preparation industry?

Technology significantly streamlines the tax preparation process by automating calculations, enhancing data accuracy, and reducing time spent on administrative tasks. This allows tax preparers to focus more on client relationships and strategy.

What tools and software can enhance the efficiency of a tax preparer?

Popular tools and software include tax preparation software like TurboTax, H&R Block, and Drake Tax, as well as productivity tools like Microsoft Excel and project management applications to help organize tasks and client data.

What career advancement opportunities exist for tax preparers?

Tax preparers can pursue various career advancement opportunities, including specializing in areas like forensic accounting, estate planning, or corporate taxation, as well as moving into senior roles or starting their own tax preparation firms.

Is there a demand for tax preparers in the job market?

Yes, there is a steady demand for tax preparers, especially during tax season. With increasing complexity in tax regulations and a growing number of individuals and businesses seeking assistance, the profession continues to offer job opportunities.