Calculating Your Tax Liability

When calculating your tax liability, it is essential to gather all relevant financial documents, including your income statements, deductions, and credits. Understanding your total income will provide a foundation for determining your taxable income. Familiarize yourself with allowable deductions, which can range from standard deductions to itemized ones, depending on your situation. This step is crucial in ensuring you accurately assess how much you owe the IRS or can expect as a refund. For those in Texas, consultations on Texas Tax Preparation can also assist in navigating any state-specific nuances.

Tax calculations involve various methodologies to ensure accuracy, such as using tax software or manual calculations. Software options can streamline the process by automating many calculations, which helps reduce errors. It is also wise to keep track of any changes in the tax code, as these can impact your liability. Engaging in Texas Tax Preparation services can further clarify things like local exemptions or credits available to residents, providing an additional layer of support in the preparation process.

Methods for Accurate Tax Calculations

Accurate tax calculations are essential for avoiding errors that can lead to penalties or excessive payments. One effective method is to gather all relevant financial documents, including W-2s, 1099s, and receipts for deductions. Utilize tax software designed to guide you through the calculation process. These programs often include built-in tools that help ensure compliance with current tax laws and maximize deductions.

In addition to software, organizing your financial information is crucial. Create a spreadsheet or use tax preparation apps to track your income and expenses throughout the year. Focus on itemizing deductions where applicable, which can benefit your overall tax liability. For those in Lubbock, Texas, tax preparation can be simplified by considering local guidelines, as state-specific rules can influence your calculations.

Filing Your Tax Return

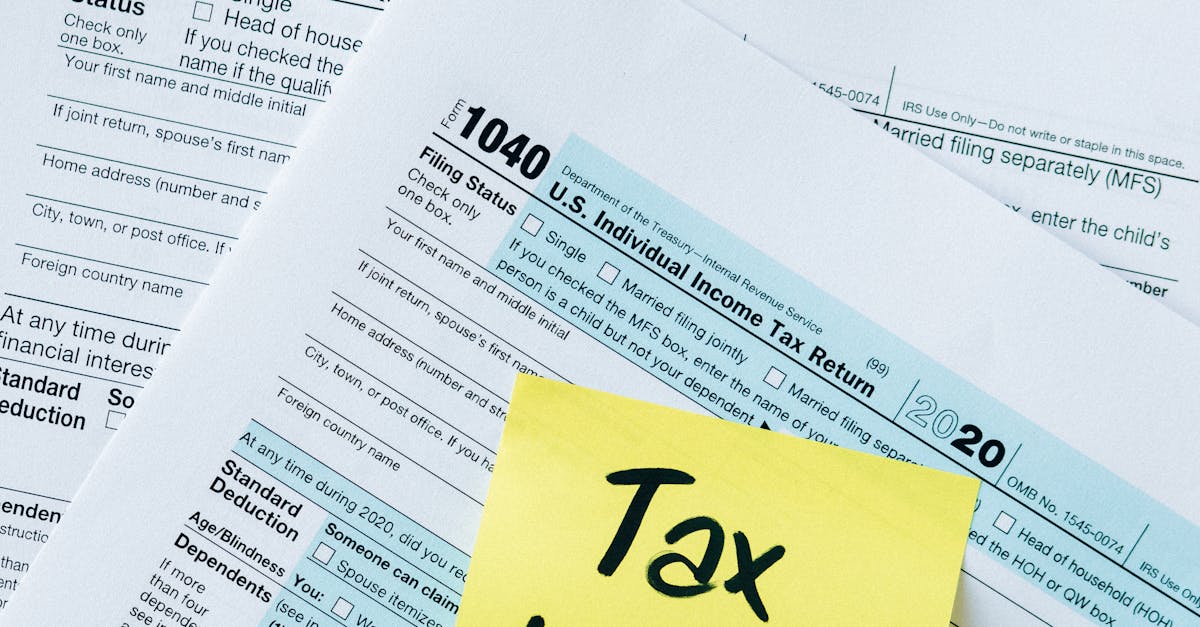

Filing your tax return requires attention to detail and organization. Begin by gathering all necessary documentation, including W-2 forms, 1099s, and any relevant receipts for deductions or credits. Organizing your documents in advance can help streamline the process and ensure that you do not miss any important information. If you are using tax software, follow the prompts carefully. The software often provides guidance, making it easier to navigate through complex tax situations. For those in Lubbock, Texas Tax Preparation professionals can also offer assistance and advice throughout the filing process.

When you have completed your return, it’s crucial to review the information for accuracy before submission. Double-checking your figures and ensuring all forms are filled out correctly can prevent errors that might delay your processing or trigger audits. After filing, be sure to keep copies of everything for your records. In Lubbock, Texas Tax Preparation services often recommend tracking your return status, which can provide peace of mind as you await your refund or confirmation of acceptance.

Step-by-Step Guide to Completing Your Tax Return

Getting started on your tax return requires gathering all necessary documents. Collect your W-2s, 1099s, receipts, and any other paperwork that details your income and potential deductions. Organizing these materials in advance simplifies the process and ensures you won’t overlook vital information. If you’re utilizing software for tax preparation, ensure it’s up to date. For residents in regions such as Lubbock, Texas, tax preparation guidelines may vary slightly based on local regulations.

Next, begin filling out the forms based on the information collected. Start with personal details before moving on to income sections. Report all applicable incomes and proceed to claim deductions. It’s important to double-check each entry for accuracy. If needed, take advantage of resources that provide assistance specific to Lubbock, Texas tax preparation. Review the completed return thoroughly before submission to avoid common mistakes that could delay processing.

Understanding State vs. Federal Taxes

Understanding the differences between state and federal taxes is crucial for anyone preparing their tax returns. Federal taxes are uniform across the country, determined by the Internal Revenue Service (IRS). In contrast, state taxes can vary significantly from one state to another, with each state having its own rules and rates. Residents must navigate different tax structures and regulations depending on where they live or earn income. Lubbock, Texas tax preparation can present unique considerations due to Texas not having a state income tax, which simplifies the filing process compared to states with income tax systems.

When preparing taxes, it’s essential to know that federal tax obligations cover a range of income types, while state requirements may focus on different criteria, including property or sales tax. Additionally, some benefits and deductions might be applicable at the federal level but not on state returns. Comprehending these distinctions helps taxpayers ensure they meet all legal obligations and make the most of potential deductions specific to their location. Understanding the nuances of both state and federal tax systems can lead to a smoother filing experience and minimize errors.

Key Differences Between State and Federal Filing

When preparing your taxes, it is essential to understand the distinctions between state and federal tax filing requirements. Federal taxes are consistent across the nation and adhere to guidelines set by the Internal Revenue Service (IRS). On the other hand, state taxes can vary significantly from one state to another. Each state has its own tax rates, deductions, and credits, which can impact how much you owe or receive in refunds. For instance, Lubbock, Texas tax preparation must account for the specific regulations and obligations of Texas, including the lack of a state income tax.

Additionally, federal tax returns typically have more standardized forms and processes, while state tax filing may involve unique forms and local regulations. Understanding these differences is crucial for accurate tax preparation. Missing a state-specific requirement could lead to penalties or missed deductions. Investing time in learning the specifics of state tax laws, such as those relevant to Lubbock, Texas tax preparation, can ultimately save time and money during the filing process.

FAQS

What documents do I need to prepare my taxes myself?

To prepare your taxes, you will typically need your W-2 forms, 1099 forms, receipts for deductions, bank statements, last year’s tax return, and any other relevant income or expense documentation.

Can I use tax software to file my taxes?

Yes, using tax software is a popular and efficient way to prepare your taxes. Many programs guide you through the process step-by-step and help ensure accurate calculations.

What is the deadline for filing my tax return?

The deadline for filing your federal tax return is typically April 15th each year. If this date falls on a weekend or holiday, the deadline may be extended. State deadlines may vary, so it’s important to check your state’s requirements.

How do I know if I should file state taxes in addition to federal taxes?

You should file state taxes if you reside in a state that imposes an income tax. Check your state’s tax agency website for specific requirements and guidelines on when and how to file.

What should I do if I owe taxes and can’t pay them all at once?

If you owe taxes but cannot pay the full amount, you can apply for a payment plan with the IRS or your state tax agency. They may allow you to pay in installments over time.