Discounts and Promotions

H&R Block frequently offers discounts and promotions to attract new customers and retain existing ones. For example, during tax season, they may provide limited-time deals on tax preparation services that can significantly reduce the cost of filing. Customers can often find information about these offers on their website or by visiting a local branch. Tax Preparation Texas clients may discover additional promotions specific to their state, making it beneficial to stay informed about region-specific deals.

First-time customers are usually eligible for special pricing or incentives when they choose H&R Block for their tax needs. These offers might include discounts on services or guarantees for a flat fee on simple returns. Individuals seeking guidance in Tax Preparation Texas should explore these introductory deals, as they can lead to substantial savings. Staying updated on seasonal offers will ensure clients take full advantage of the best prices available.

Seasonal Offers and First-Time Customer Deals

H&R Block frequently offers seasonal promotions that can help customers save on their tax preparation services. These deals are particularly appealing during tax season when individuals are looking for ways to reduce costs while ensuring their returns are filed accurately. First-time customers often find special offers that provide discounts or lower flat rates for their initial experience with H&R Block. Seasoned clients can also benefit from occasional promotions, rewarding loyalty with reduced fees or additional services.

Additionally, consumers in places like Tax Preparation Texas might see localized offers that cater specifically to their region. These promotions can include bundled services or incentives for referring new clients. Staying informed about these seasonal deals can result in significant savings, making tax preparation more accessible and budget-friendly for many individuals. Customers are encouraged to visit H&R Block’s website or their local offices to access the latest promotions available in their area.

Payment Options Available

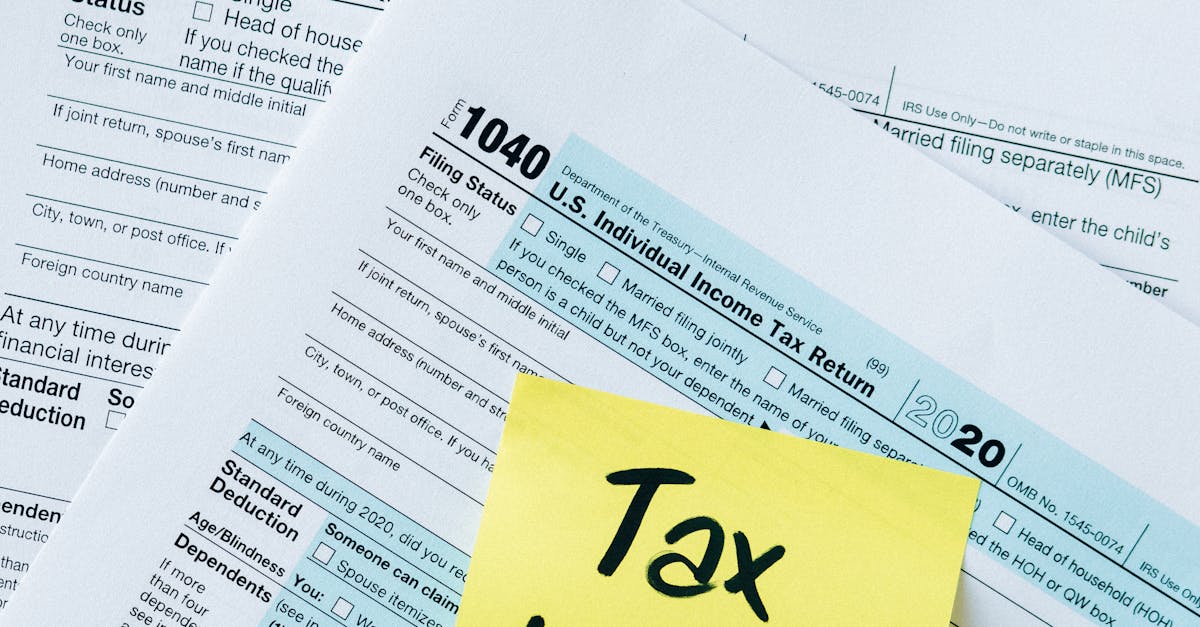

H&R Block provides multiple payment options for customers seeking tax preparation services. Clients can opt to pay directly after their return is filed or choose to finance their services through H&R Block’s installment plans. These flexible options cater to various preferences, making it easier for clients to manage the costs associated with tax preparation.

Additionally, the convenience of online payments is available for those using the digital filing services. Customers in Tax Preparation Lubbock, Texas, can also make use of in-person payment methods at local offices. This ensures that clients have access to various ways to settle their fees, enhancing the overall experience of using H&R Block’s services.

Methods to Pay for Services

H&R Block provides several payment options for its tax preparation services, accommodating various preferences. Customers can choose to pay directly with a credit or debit card, making transactions straightforward and convenient. For those seeking flexibility, H&R Block also offers a refund transfer option, allowing clients to have their fees deducted directly from their tax refunds. This can lessen the upfront financial burden, especially beneficial during busy tax seasons.

For residents seeking services such as tax preparation in Lubbock, Texas, H&R Block ensures that payment methods cater to both individual and business needs. Additionally, customers may opt for in-person consultations, providing the chance to discuss personalized payment plans with professionals. By prioritizing diverse payment options, H&R Block aims to enhance customer satisfaction and accessibility in tax-related services.

Customer Experience with H&R Block

Customer experiences with H&R Block vary widely, reflecting individual expectations and circumstances. Many customers appreciate the knowledgeable tax professionals who guide them through the preparation process. The availability of local offices, such as those in Tax Preparation Lubbock, Texas, contributes to a personalized experience for local residents who seek assistance with their filings.

Reviews often highlight the ease of scheduling appointments and the convenience of online services offered by H&R Block. Additionally, some users mention challenges they faced during peak tax season, such as longer wait times. However, overall feedback indicates that many customers feel a sense of relief and satisfaction after having their returns prepared accurately by H&R Block’s team.

Reviews and Ratings from Users

Customers generally express satisfaction with the services provided by H&R Block, noting the efficiency and professionalism of their tax preparers. Many users appreciate the thoroughness with which their returns are handled. In larger cities like Lubbock, Texas, the accessibility of in-person support is a significant advantage. Positive reviews often highlight the clarity of communication and the willingness of staff to answer questions.

However, some users report mixed experiences. Certain clients feel that the costs can be higher than expected for a simple tax return, particularly in competitive markets such as Tax Preparation Lubbock, Texas. Additionally, some feedback points towards the variable quality of service depending on the specific office location. Overall ratings often reflect the importance of individual tax preparers in shaping the customer experience.

FAQS

What is the average cost of a simple tax return with H&R Block?

The cost for a simple tax return with H&R Block typically ranges from $50 to $150, depending on the complexity of your tax situation and any additional services you may choose.

Are there any discounts available for first-time customers at H&R Block?

Yes, H&R Block often offers promotions and discounts for first-time customers. These can include a percentage off their service fees or a flat-rate discount when you file your tax return.

What payment options does H&R Block offer for tax preparation services?

H&R Block provides various payment options, including credit and debit cards, cash, and check. Additionally, they offer the option to deduct fees from your tax refund.

How do customers generally rate their experience with H&R Block?

Customer reviews for H&R Block vary, but many users appreciate the professional service and guidance provided by tax preparers. Overall ratings tend to be favorable, though some customers may have concerns about pricing.

Can I file my taxes online with H&R Block, and what are the associated costs?

Yes, you can file your taxes online with H&R Block. The costs for online filing typically start lower than in-person services, with options available for free filing for simple returns, and pay-as-you-go plans for more complex needs.