Hidden Fees to Watch Out For

When seeking tax preparation in Texas, it is essential to be aware of potential hidden fees that could inflate your overall costs. Some preparers may advertise low rates, but additional charges often appear during the filing process. Common pitfalls include fees for e-filing, state returns, and even consultations that some customers assume are included in the initial quote.

Additionally, clients should scrutinize any extra costs related to document handling and storage. Charges for specialized services, such as dealing with complex situations or amending previous returns, might catch individuals off guard. Thoroughly reviewing the submitted agreement and asking targeted questions can help identify these potential fees beforehand.

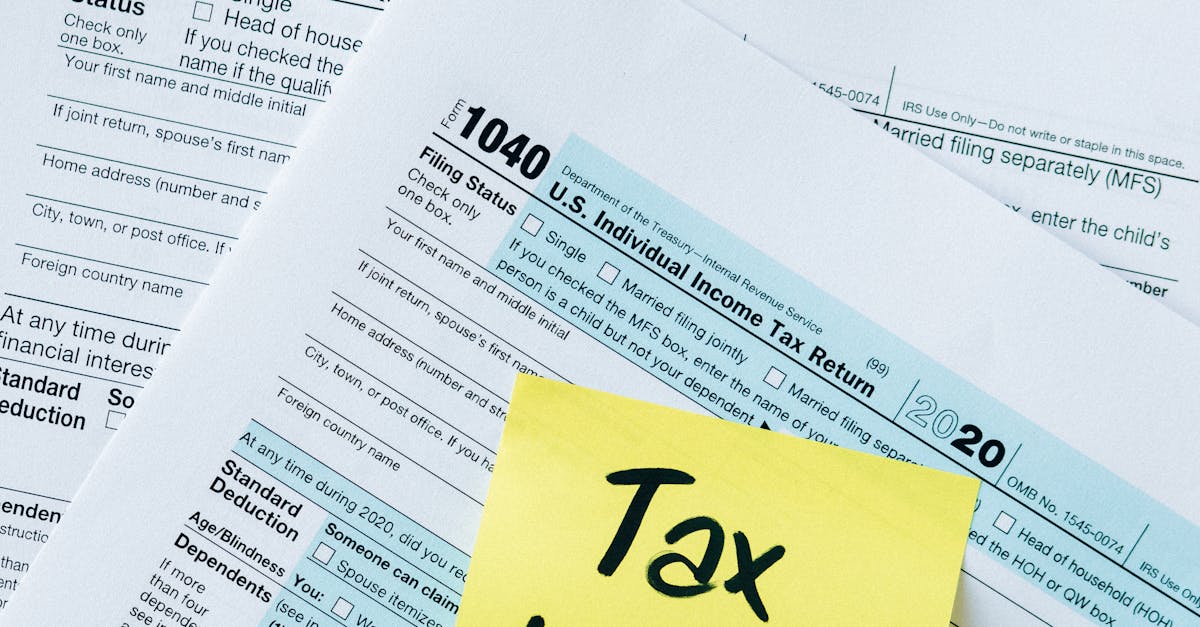

Common Additional Charges

When engaging a tax preparer, clients should be aware of potential additional charges beyond the standard fee. Common issues may arise from services like filing state tax returns, which can carry a separate cost. If a tax preparer needs to amend a previous year’s return or provide extra assistance in gathering necessary documents, these services could also result in increased charges. Tax Preparation in Texas often includes various nuances due to state-specific regulations, which may further influence the overall cost.

Clients might also encounter fees related to e-filing, direct deposit setups, and consultation sessions beyond the initial appointment. Each of these services could enhance convenience and accelerate the refund process but may not be included in the initial quoted price. Being informed about these potential extra costs helps taxpayers budget their expenses more accurately as they prepare for the upcoming tax season.

Benefits of Using a Tax Professional

Engaging a tax professional can provide significant advantages that extend beyond mere numbers. Professionals bring expertise and experience, navigating complex tax laws effectively. They can identify potential deductions and credits that individuals might overlook, potentially resulting in more significant savings. For those seeking reliable assistance, tax preparation in Lubbock, Texas, offers access to knowledgeable preparers familiar with local regulations and community-specific tax incentives.

Moreover, working with a tax professional often alleviates the stress associated with tax season. The process can be daunting for many, leading to anxiety over filing accurately and on time. Tax preparers can handle the paperwork, ensuring compliance and reducing the likelihood of audits. Their guidance can help clients make informed financial decisions, providing peace of mind during tax time.

Value Beyond Just Cost

Choosing a tax preparer goes beyond just looking at the fees associated with their services. Professionals in the field not only offer expertise but also provide peace of mind. They stay updated on constantly changing tax laws and can identify potential deductions that a layperson might overlook. This knowledge can translate into significant savings on tax liabilities, ultimately making the investment in a tax preparer worthwhile for many individuals and businesses.

In regions like Lubbock, Texas, local tax preparers often possess specific insights into state and local tax nuances. They can offer personalized advice tailored to the unique financial situations of clients in the area. This localized expertise can enhance the overall value of their services, ensuring that clients maximize their tax benefits while minimizing errors and potential audits. By investing in professional help, taxpayers can focus on other important aspects of their lives, confident that their tax obligations are in good hands.

Discounts and Promotions Available

Many tax preparers offer discounts and promotions to attract new clients and retain existing ones. These deals may include a percentage off for early filers or special pricing for referrals, which can significantly reduce the overall cost of services. It’s worth inquiring about any available offers when seeking tax preparation in Lubbock, Texas, as local firms often tailor their promotions to fit the community.

Additionally, seasonal promotions surrounding tax season may increase as the filing deadline approaches. Some preparers also provide bundled services at a reduced rate, which can offer more value if you require assistance with multiple tax-related issues. Keeping an eye out for these opportunities can help you save money while ensuring you receive professional help.

Ways to Reduce Your Tax Prep Expenses

Tax preparation costs can add up quickly, but there are several strategies to help reduce these expenses. One effective method is to research local tax preparers and compare their fees. Many professionals offer competitive rates, and taking the time to shop around might reveal a significant price difference. Additionally, some preparers provide discounts for early bookings or referrals.

Utilizing online tax preparation software is another way to cut costs. Many of these platforms offer tiered pricing models, allowing taxpayers to choose a package that suits their needs without overspending. For residents interested in Tax Preparation in Texas, many local firms may offer seasonal promotions or bundled services, making it easier to find cost-effective solutions tailored to individual tax situations.

FAQS

How much do tax preparers typically charge for their services?

Tax preparers generally charge between $150 to $500 for basic tax preparation services, depending on the complexity of your tax situation and the region where you live.

Are there hidden fees I should be aware of when hiring a tax preparer?

Yes, some tax preparers may charge additional fees for services such as filing state returns, providing audit protection, or for any additional forms required, so it’s important to inquire about all potential costs upfront.

What are some common additional charges I might encounter?

Common additional charges can include fees for e-filing, preparation of additional schedules, or for handling more complex tax situations, such as self-employment income or investment income.

What are the benefits of using a tax professional instead of doing it myself?

Tax professionals can provide expertise and personalized guidance, help identify potential deductions or credits you may have missed, and ensure that your tax return complies with the latest tax laws, which can save you money and time.

Are there ways to reduce my tax preparation expenses?

Yes, many tax preparers offer discounts for early filing or for referring new clients. Additionally, some organizations provide free tax preparation services for low-income individuals or seniors, which can help reduce costs.